Risk Management Policy

- In order to build a complete risk management system; strengthen effectiveness of corporate governance; ensure comprehensiveness, effectiveness, and reasonableness of risk management, as well as effectively evaluate and oversee risk-bearing capabilities of the Corporation to determine risk response strategies and implementation of risk management procedures, the Corporation's "Risk Management Regulation" and related "Risk Management Policies" were established following approval of the 27th meeting of the 8th Board on June 19, 2019, the "Risk Management Measures" were revised to "Risk Management Procedures" in 2024 and were approved by the 15th Board of Directors of the 10th session on July 10 to provide reasonable assurance of the Corporation's mid- to long-term strategic plans and achievement of targets, and to assist the company's stable operation and sustainable development.

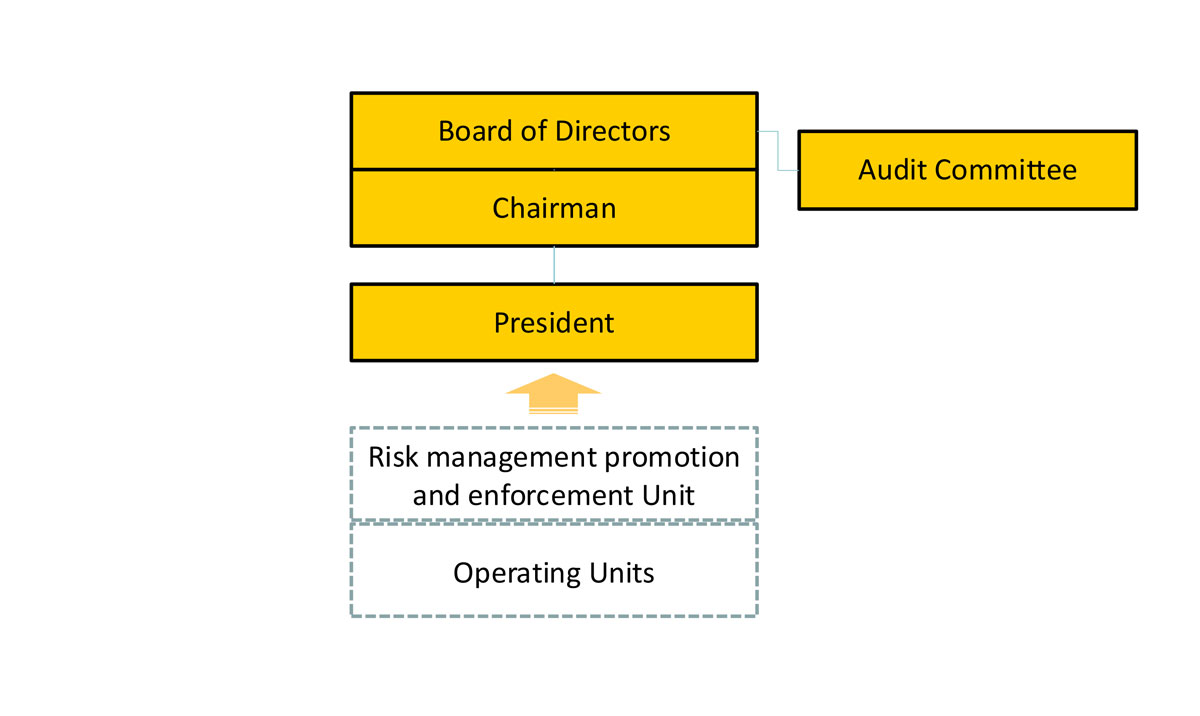

- The Company's Audit Committee assists the Board of Directors in supervising the relevant operating mechanisms of risk management.

- The Corporation has inventoried and identified, in a proactive and cost-effective manner, possible risks that may impact operations and profits due to Corporation business and operational activities, the main considerations being business environments, operations, finances, hazardous incidents, and other aspects. We have also reviewed comprehensiveness of corporate risk management procedures and effectiveness of risk management controls, and conducted risk evaluations of environmental, social, and corporate governance issues relating to operations by principle of materiality; these evaluations are used to establish implementation systems and identify main risk categories. For more information regarding these risks and relevant response measures and actions, please refer to the following table.

- The Corporation's various committees (such as the Audit Committee, Safety Committee, Information Security Committee, Sustainable Development Promotion Committee, and so on) and each operating units all participated in establishing the aforementioned risk management measures, issues, evaluations, and polices, and assist in promotion.

Implementation Statuses

The Corporation began actively promoting risk management procedures in 2018 and reports on implementations to the Board of Directors once every year. Main implementations in recent years include:

2018

• Risk management report was acknowledged by the Board of Directors in December 2018.

2019

• Risk management regulation and risk management policy were issued in 2019.

• Annual risk management report (including risk management implementation status and progress) was acknowledged by the Board of Directors in September 2019.

2020

• Annual risk management report (including risk management implementation status and progress) was acknowledged by the Board of Directors in September 2020.

2021

• Annual risk management report (including risk management implementation status and progress) was acknowledged by the Board of Directors in September 2021.

2022

• Annual risk management report (including risk management implementation status and progress) was acknowledged by the Board of Directors in September 2022.

2023

• Annual risk management report (including risk management implementation status and progress) was acknowledged by the Board of Directors in September 2023.

2024

• Annual risk management enforcement report was presented to the Audit Committee and the Board of Directors in September 2024. The report encompasses the Corporation's risk categories, important items for risk management, and risk assessments. Units responsible for management of different risk categories have all adopted appropriate response measures and made suitable records of risk management procedures and implementation results.

• To strengthen risk management mechanisms, risk management courses have been organized for relevant personnel. A total of 5,224 personnel underwent 6,453 hours of training to strengthen their corporate risk management awareness and understanding.

2025

• Annual risk management enforcement report was presented to the Audit Committee and the Board of Directors in March 2025. The report encompasses the Corporation's risk categories, important items for risk management, and risk assessments. Units responsible for management of different risk categories have all adopted appropriate response measures and made suitable records of risk management procedures and implementation results.

• To strengthen risk management mechanisms, risk management courses have been organized for relevant personnel. A total of 9,412 personnel underwent 9,617 hours of training to strengthen their corporate risk management awareness and understanding.

Implementation structure for risk management:

Risk Assessments and Response Measures

Main risk categories, risk assessments and response measures:

| Main Risk Categories | Risk Assessments | Risk Management Strategies and Related Response Measures |

|---|---|---|

| Strategic Risks | Assess the possible impact of the company's adoption of other alternative renewable energy sources or measures to reduce greenhouse gas emissions under the green energy policy. |

|

| Operating Risks | Assess HSR systems that may be affected by internal and external factors, such as malfunctions of facilities and equipment, human error, intentional sabotage or other external factors, which may affect train safety; cause physical or mental harm to our employees, passengers, contractors or the general public; or cause delay or cessation of rail operations. |

|

| Environmental Risks | Assess various environmental risks (such as global warming, extreme weather conditions, earthquakes, land subsidence, formation of new fault lines, and natural resource loss) can cause revisions in laws and regulations, system damages, regional power cuts, and water shortages, which may affect service quality and increase maintenance and operation costs. |

|

| Financial Risks | Assess changes in domestic and overseas economic and financial conditions that may impact our income, maintenance and operation costs, interest rates, and exchange rates, which in turn may affect our profitability and cash flows. |

|

| Information Risks | THSRC is a national critical information infrastructure provider, and the cyber security responsibility levels shall be submitted to the Executive Yuan for approval by the Ministry of Transportation and Communications. Depending on its cyber security responsibility levels, assess all HSR information systems and take various aspects into account, including confidentiality, comprehensiveness, accessibility, and legal compliance. |

|

| Compliance Risks | Based on the understanding and measurement of laws and regulations issued by the competent authorities, we effectively update the company's internal rules and regulations to reduce any possible impact. |

|

| Goodfaith Risks | Evaluate that company personnel, in the course of executing business, directly or indirectly provide, accept, promise or request any improper benefits in order to obtain or maintain benefits, or engage in other violations of integrity, illegality or breach of fiduciary obligations, which may have a negative impact on the company's reputation, finance and shareholder's trust, etc. |

|